How to De-Risk Your Portfolio

I haven’t touched too much yet on sell techniques, and plan on doing a future article that dives a little more in depth into the subject since there are many nuisances to it and it’s one of the most important aspects of portfolio management.

The art of selling isn’t only about locking in profits, but it’s also about portfolio protection. So I at least wanted to do a very short write-up to touch on how to de-risk your portfolio quickly by scaling out (selling a portion) of a position. This will allow you to hold onto a position with its original stop-loss location intact - thus giving it some more room for fluctuation - and get a financed (free) opportunity to ride it out for a longer move.

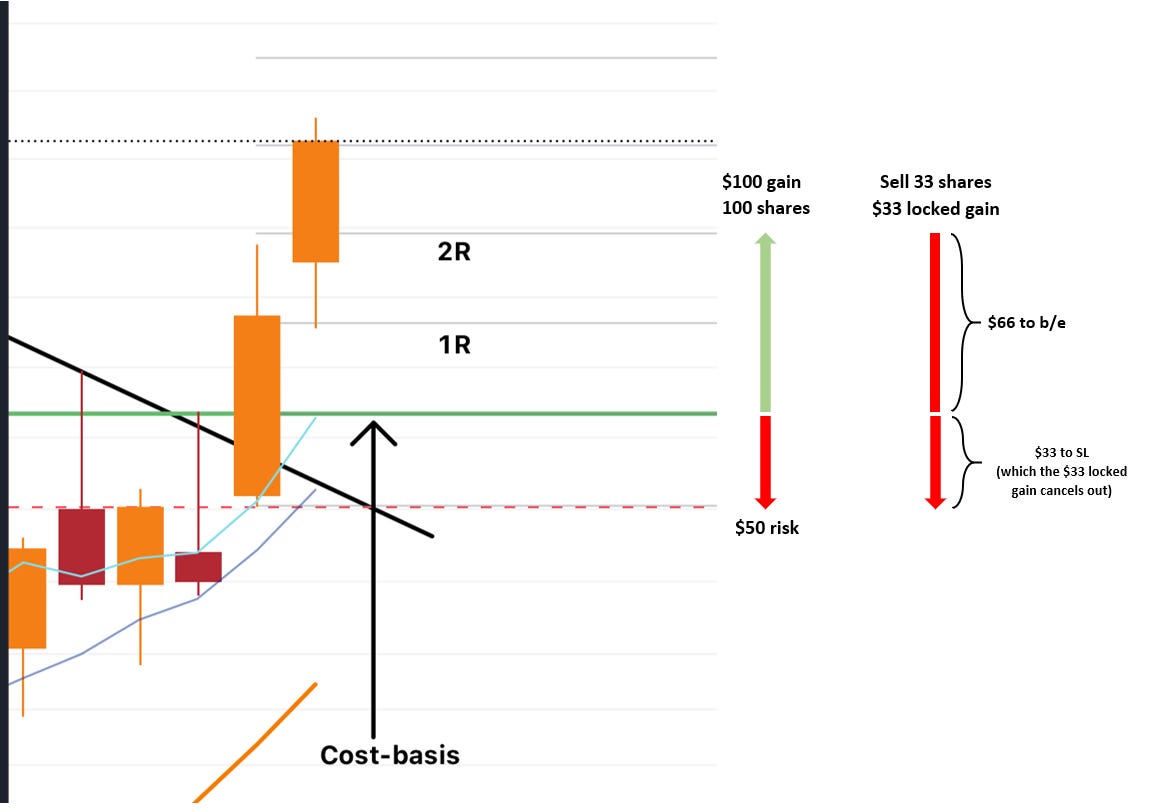

So let’s get into it. Please take a look at the chart below and study it well.

In a good market, like we’re in right now, I like to scale out 1/3 of my total position at a 2R gain. 2R means that I have made twice as much on the trade as I originally risked (so if I risk $50, 2R means I have $100 of profit on the trade). The green line in my example above shows my cost-basis (my average buy price on this trade) and the red-dotted line is the location of my stop-loss. In this example you can see that the distance from cost-basis to stop-loss is risking $50. So with that number in mind, if I sell 1/3 of the position at 2R (or as mentioned, with $100 of profit) and leave my stop-loss where it is, that trade could then drop all the way back to my stop-loss and stop me out without having lost any money at all. The math may be a little challenging to wrap your head around, but the reason for this is two-fold: you have 1/3 of your profit locked in from the sale, and you now have a smaller position than you originally had, so if the price moves back toward your stop-loss it has a less dramatic effect on the drawdown of the position.

As I mentioned, 1/3 at 2R is something I like to incorporate in a good market. But what about a tougher market that doesn’t really allow you to capture multi-week trends? Alternatively you could adjust this to a 1/2 at 2R approach and this will actually lock in profit for each trade instead of only locking in your breakeven point. Some traders are very sensitive to the amount of drawdown they have in their portfolio as well, which could lend nicely to the 1/2 at 2R approach. Just know that this approach will also reduce your total returns when compared to the 1/3 at 2R approach, since you’ll have a smaller position that you’re holding for a bigger move.

This also highlights the importance of precise entries. Which is easier to attain, a 5% gain or a 20% gain in a stock? Obviously a 5% gain is much easier. Following the 2R approach that means that your distance from cost-basis to stop-loss should be no more than 2.5%. However to gain 2R on a 10% stop-loss you’d need a 20% return on that stock. For tips on sniper entries please see the link at the bottom of this article.

So there it is. Nothing super complicated, yet very important to know so as to protect your breakeven point and “finance” your risk. This is a concept that one of my mentors - Leif Soreide - would refer to as “getting a free look at a stock”. It’s a lot easier to sit with a position if you know it’s already “paid for”. Hope this was helpful. Happy trading!

-Big Wave Chartist