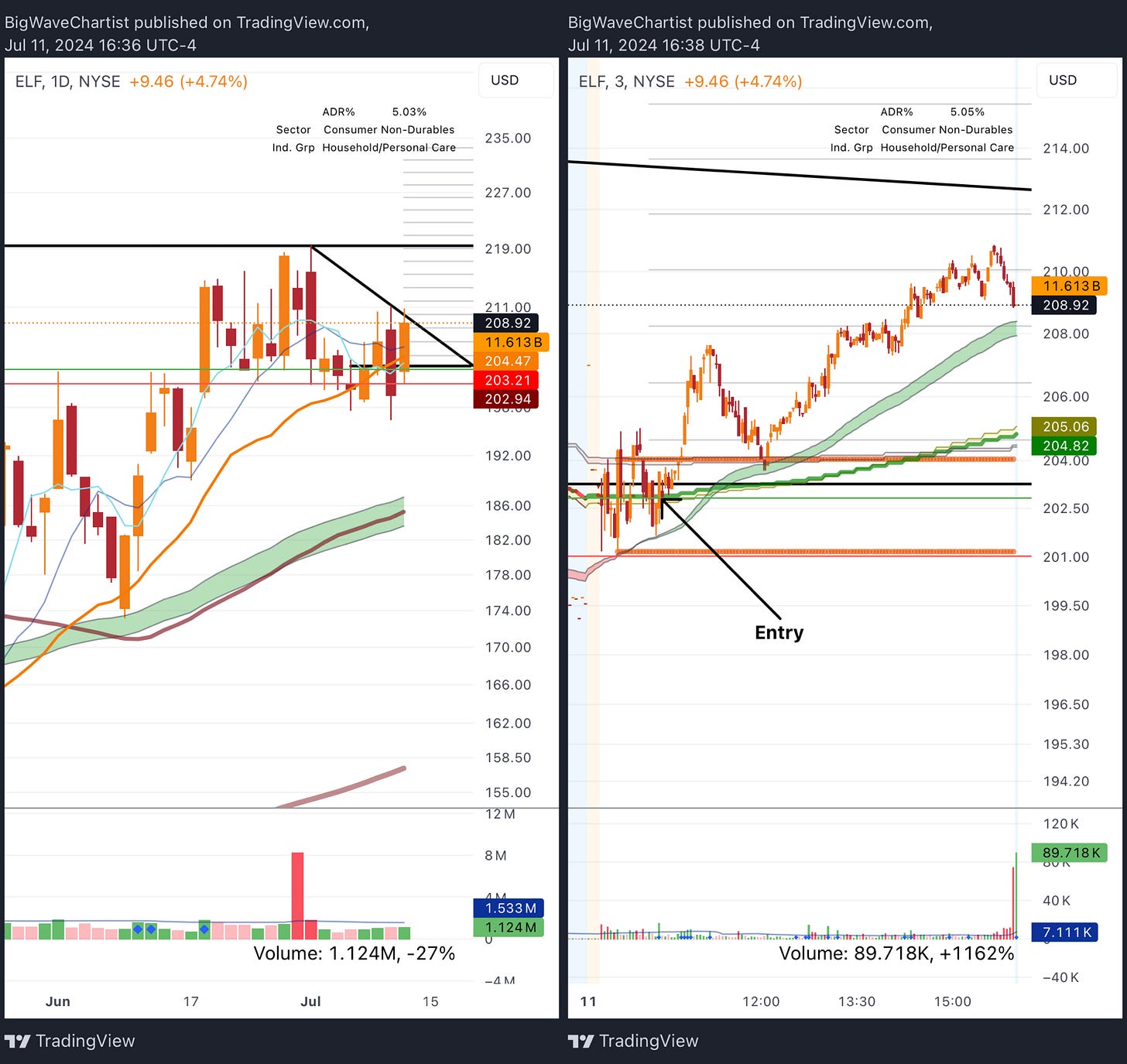

I opened ELF on a intraday Gold Band breakout and sold 1/3 up 2R, so it’s de-risked and closed strong.

I also opened PSTG on a potential undercut and rally on the intraday chart. It was riskier but offered tiny risk. I sold 1/3 up 2R, making it de-risked as well.

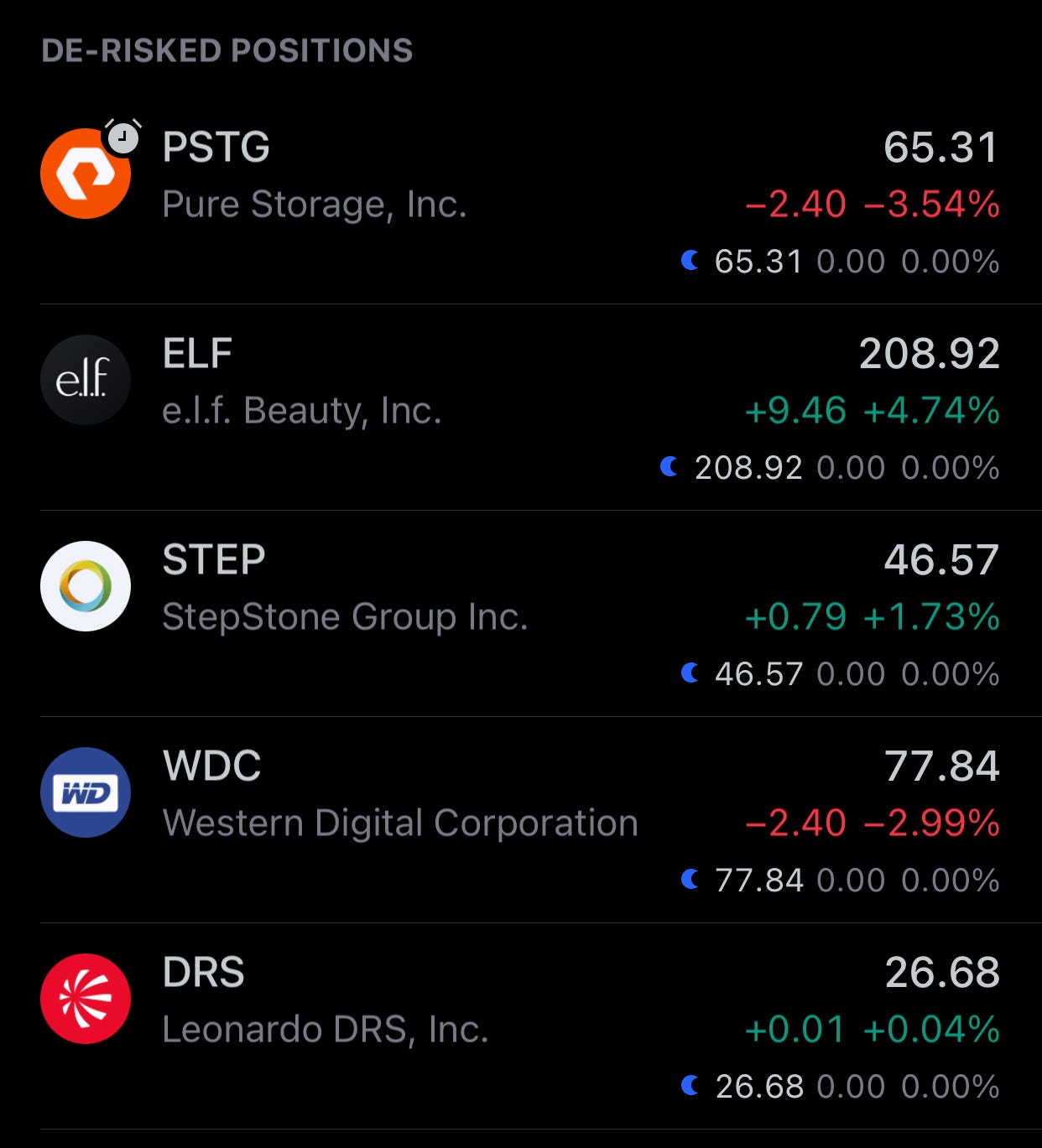

As usual, in my charts below the green horizontal line is my purchase price and red line is the stop-loss. My portfolio consists of the following positions:

NEW POSITIONS :

DISCLAIMER:

The Big Wave Report and all articles produced by its authors are for educational purposes ONLY. No content constitutes - or should be understood as constituting - a recommendation to enter in any securities transactions or to engage in any of the investment strategies presented in our articles. We do not serve as an investment advisor, therefore we do not provide personalized recommendations or views as to whether a stock or investment approach is suited to the financial needs of a specific individual.

Investing is risky and could result in the total loss of invested principal, even with risk management precautions in place. Therefore, one should consider their investment objectives and risks carefully before investing. By subscribing to or following any of the strategies stated in this or any other Big Wave Report articles you are acknowledging that you alone accept full responsibility for all investment decisions made and will not hold The Big Wave Report or its makers responsible for any losses incurred due to investments.